2 min read

Protecting Your Assets with a Medicaird Irrevocable Trust in Colorado

Joe Whitcomb

:

October 06, 2025

What You Need to Know Before Applying for Medicaid

When you or a loved one need long-term care, Medicaid can be a lifesaver. But qualifying for

it isn’t simple—especially if you own a home or have savings. Many families look at

irrevocable trusts as a way to protect what they’ve built while still qualifying for benefits.

Before you take that step, it’s important to understand what the law actually allows.

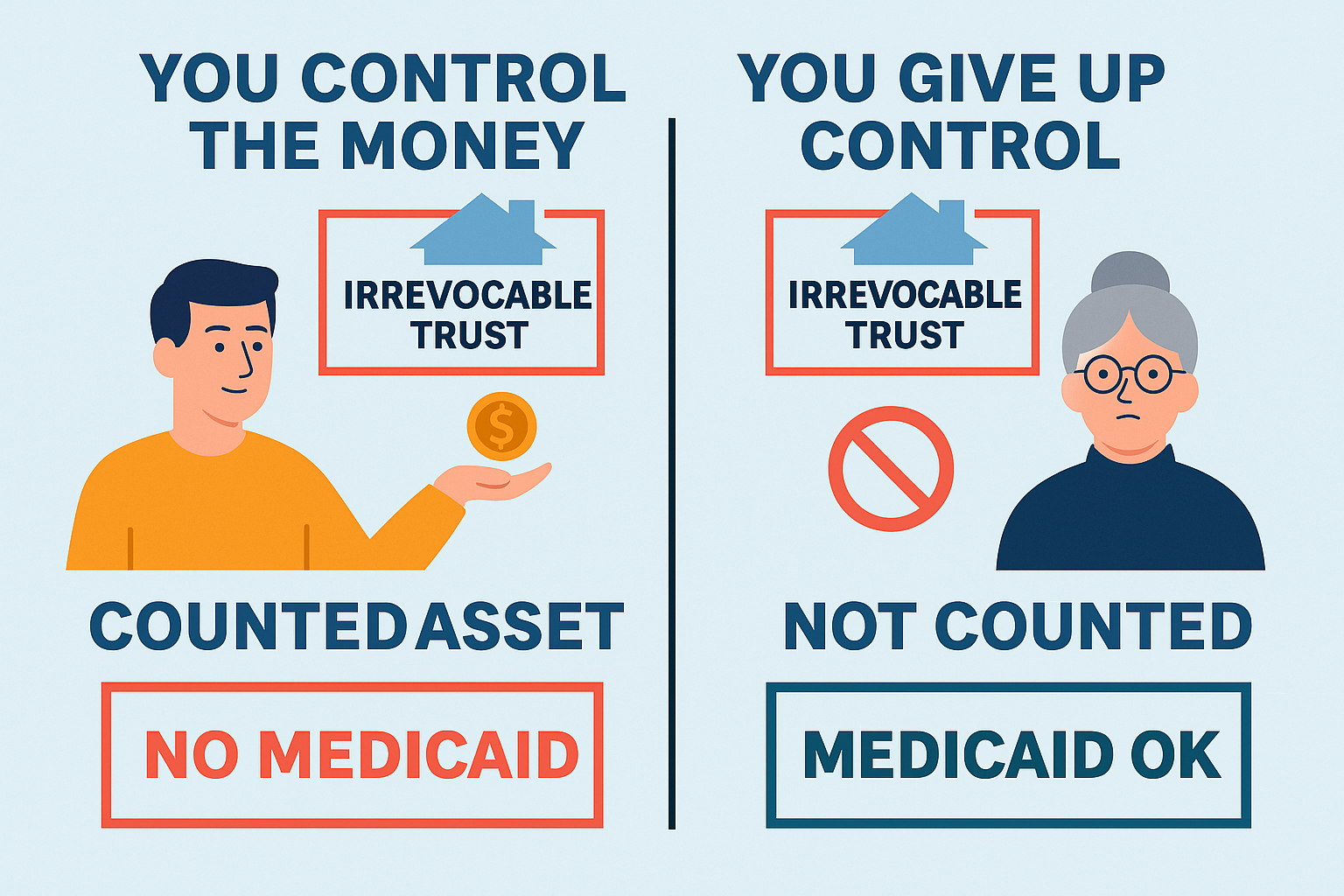

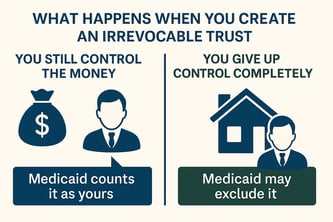

1. What Is an Irrevocable Trust?

An irrevocable trust is a legal tool that lets you place assets—like your house or bank

accounts—into a separate legal “box.” Once it’s set up, you can’t take the assets back or

change the terms without court approval. That loss of control is what gives the trust its power:

those assets might no longer count as yours for Medicaid purposes—but only if the trust is

structured correctly under both federal and Colorado law.

2. The Federal Rules (42 U.S.C. § 1396p)

Federal Medicaid law sets the ground rules for how states treat trusts. If you give away assets

or move them into a trust within five years of applying, Medicaid assumes you’re trying to hide

them. That triggers a penalty period where you must pay for your own care. Trusts funded

with your own money usually still count as your assets unless they meet narrow exceptions.

Testamentary and certain special needs trusts may be excluded.

3. Colorado’s Twist: Stricter Limits

Colorado follows the federal rules but adds its own restrictions under C.R.S. 15-14-412.5.

Courts cannot approve a trust designed to qualify someone for Medicaid unless it meets the

criteria in the Colorado Medical Assistance Act. Privately created irrevocable trusts often don’t

qualify and may still be counted as available assets.

4. Real-World Lessons from Colorado Cases

• In Kadingo v. Johnson (2017), a widow penalized for her late husband’s testamentary trust

successfully challenged parts of Colorado’s Medicaid rules in federal court. The case showed

that some federal trust protections can override unfair state interpretations. • In Estate of

Roberts (2000), Colorado upheld stricter rules, holding that a trust funded by an inheritance

(not a personal-injury settlement) could not preserve Medicaid eligibility.

5. Practical Do’s and Don’ts

Do:

• Plan ahead—at least five years before you need care.

• Use a properly drafted special-needs trust if the beneficiary is disabled and under 65.

• Get court approval when required.

• Work with an experienced elder-law attorney.

Don’t:

• Keep control over the assets and expect Medicaid to ignore them.

• Move assets right before applying.

• Assume “irrevocable” automatically means “protected.”

• Use an online trust template without legal advice.

Illustration: Counted vs. Not Counted Assets

Type of Trust |

Who Funds It |

Medicaid Counts It? |

| Revocable Trust | You | Yes |

| Irrevocable Self-Settled Trust | You | Usually Yes |

| Testamentary Trust | Someone else’s will | No |

| Special-Needs Trust | For a disabled person under 65 | No |

| Court-Approved Disability Trust | Settlement proceeds only | No |

Final Thoughts

Irrevocable trusts can be powerful tools, but they must be created with care. Colorado’s Medicaid

rules are among the strictest in the nation. If you’re considering one, consult an attorney who

understands both C.R.S. 15-14-412.5 and federal Medicaid law (42 U.S.C. § 1396p). The right advice

early on can help protect your assets and secure the care you need.

If you’re planning for long-term care or want to protect your home and savings while staying

Medicaid-eligible, the attorneys at Whitcomb, Selinsky, PC can help. We’ll review your goals,

explain your options in plain language, and make sure your plan complies with both federal

and state law.